michigan property tax rates 2020

Current and previous tax rates for City of Dearborn property owners. Michigans effective real property tax rate is 164.

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

The State of Michigan published 2020 rates in Spring 2021 Contact us at.

. Michigan has some of the highest property tax rates in the country. The 2020 average property tax bill in Michigan was about 2150 on an owner-occupied home according to data from the. However if the parcels 2019 taxable value was 100000 and its 2020 assessed value is 98000 the 2020 taxable value will be 98000 as the taxable value may not exceed.

The summer tax bill runs from July 1st of this year to June 30th of next year. In fact there are two different numbers that reflect your homes value on your Michigan real property. The IRS will start accepting eFiled tax returns in January 2020.

Rates for 2020 will be posted in august 2021. 2018 Millage Rates - A. Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan.

When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes. This link will provide. Michigan is taxed at a flat tax rate of 425 for all levels of income.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Rates for 2021 will be posted in August 2022. Millage rates are those levied and billed in 2020.

Counties in Michigan collect an average of 162 of a propertys assesed fair. The Michigan State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated. Published on 05 August 2020 Modified on 23 December 2020 By.

Ingham County has the highest average. In total Michigan county and local governments levied 146 billion in property taxes in 2018 at an average rate of 4198 mills. The winter tax bill runs from December 1st of this year to November 30th of next year.

The tax rate for the 2021 tax year is 425. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes homestead property tax credits farmland and open space tax relief and the. Follow this link for information regarding the collection of SET.

Michigan State Tax Tables each year as part of. 2019 total property tax rates in michigan total millage industrial personal ipp. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax. The average millage rate in. Michigan Extends 2020 Property Tax Appeal Deadline.

Below are a few fast facts about trends in Michigan property tax rates. 2020 Tax Rates Popular. The special exemption for the 2021 tax year is 2800.

2020 Millage Rates - A Complete List. Rates include special assessments levied. Individual Exemptions and Deferments.

Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 193869 373869 133869. But rates vary from county to county. Each mill equates to 1 of tax per 1000 of taxable value.

That compares to 141 billion levied in 2008. The qualified disabled veterans. Heres a list of the 25 Michigan cities and townships with the highest property tax rate for homeowners.

The Great Lake States average effective property tax rate is 145 well above the national average of 107. The Essential Services Assessment ESA is a state specific tax on eligible personal property owned by leased to or in the possession of an eligible claimant. 1410 Plainfield Ave NE.

2019 Millage Rates - A Complete List. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance. The personal exemption for the 2021 tax year is 4900.

28 2020 121 pm. Rates include the 1 property tax administration fee.

Michigan Property Tax H R Block

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Pin By Sandy Stevenson On Real Estate Agent Realtor Tips Real Estate Quotes Real Estate Tips Real Estate

What Do Your Property Taxes Pay For

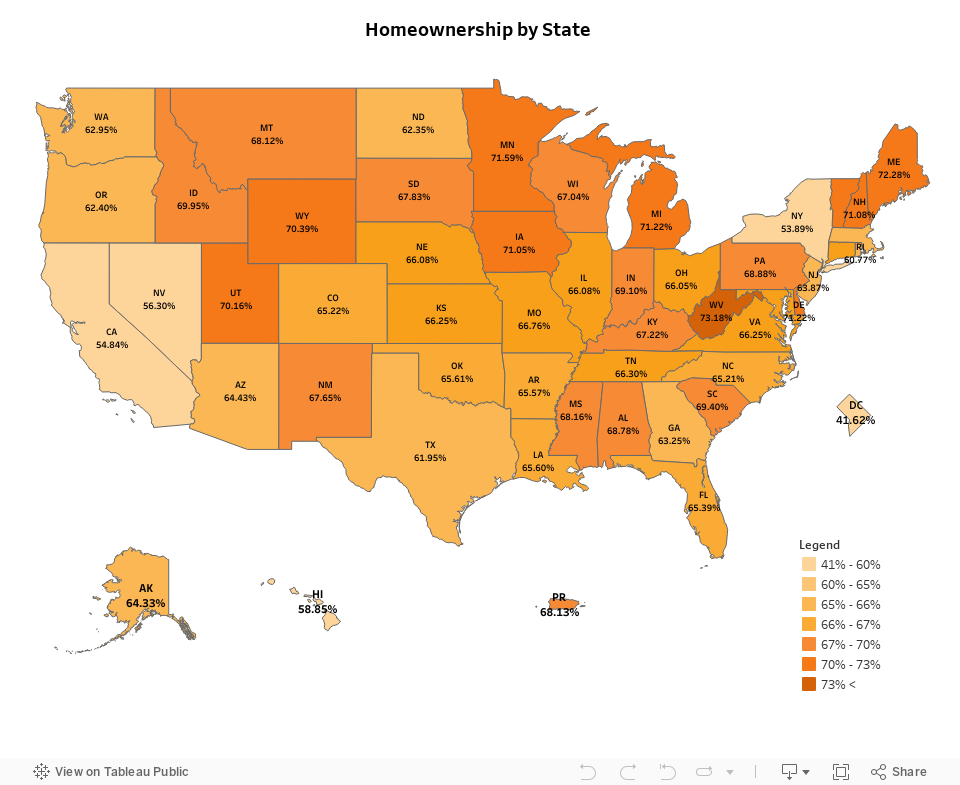

The Best State University Systems Smartasset Higher Education Education States

What Is A Homestead Exemption And How Does It Work Lendingtree

Real Estate Forecast Recession Unlikely In 2020 Real Estate Real Estate Information Real Estate Prices

Millage Taxable Value Calculator Madison Heights Mi

Montgomery County Md Property Tax Calculator Smartasset

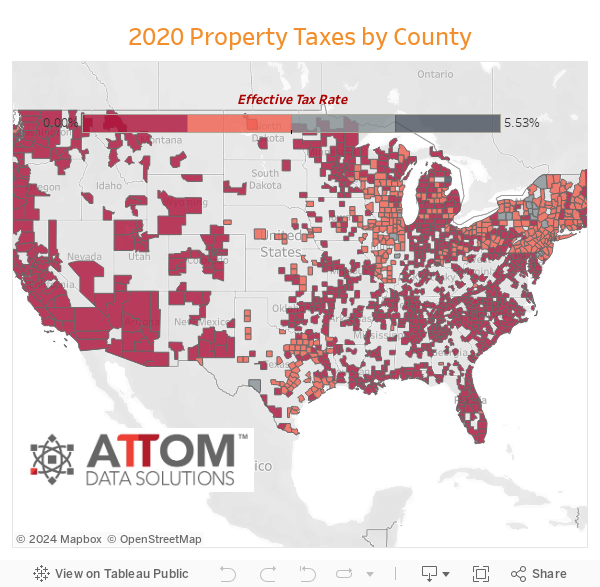

Property Taxes By State Embrace Higher Property Taxes

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

States With Highest And Lowest Sales Tax Rates

Property Taxes By State Propertyshark

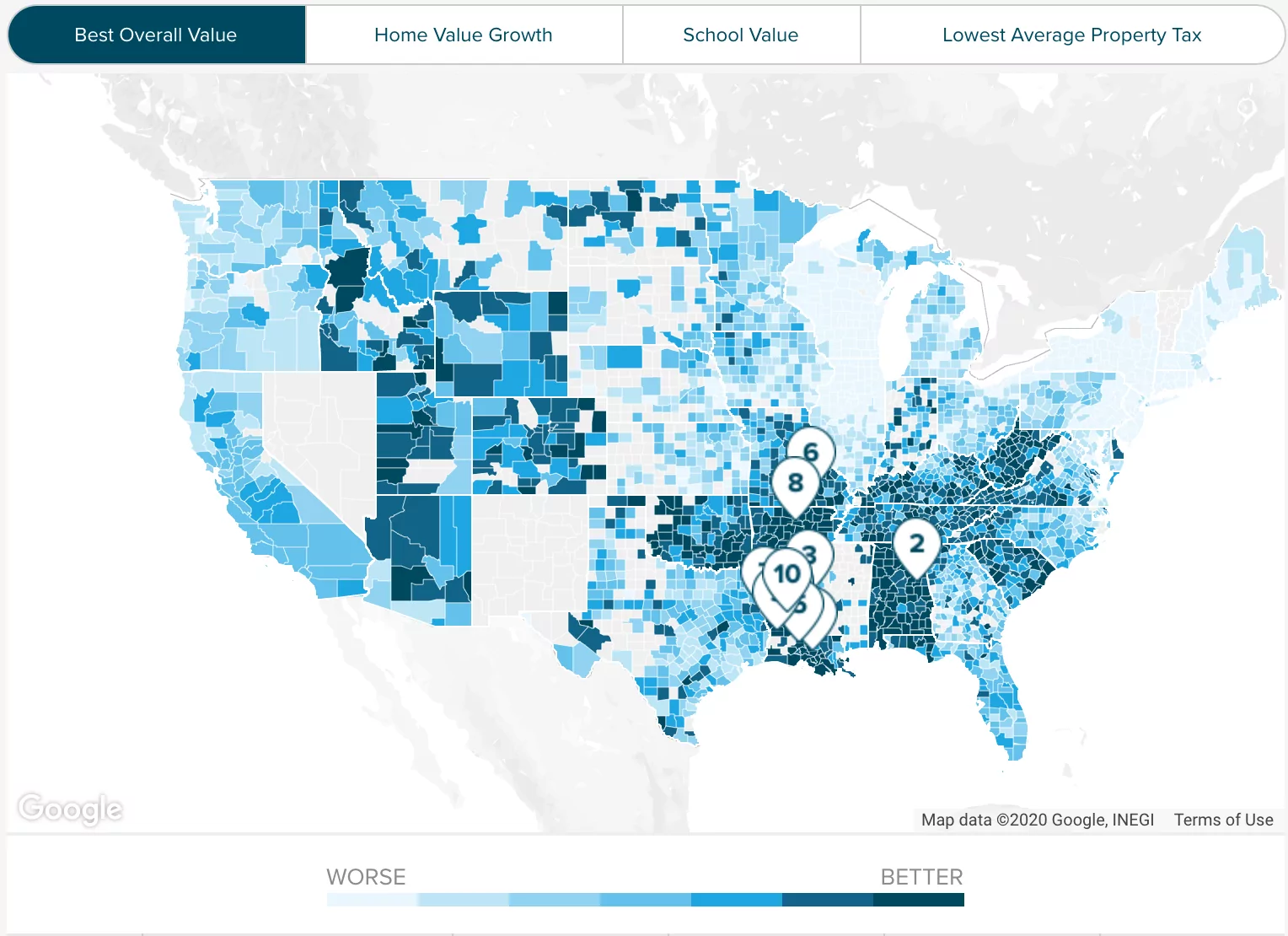

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Which U S Areas Had The Highest And Lowest Property Taxes In 2020 Mansion Global

Property Tax Comparison By State For Cross State Businesses

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation